Latest Q2 data from Synergy Research Group reveals that six colocation providers account for 37% of the worldwide market.

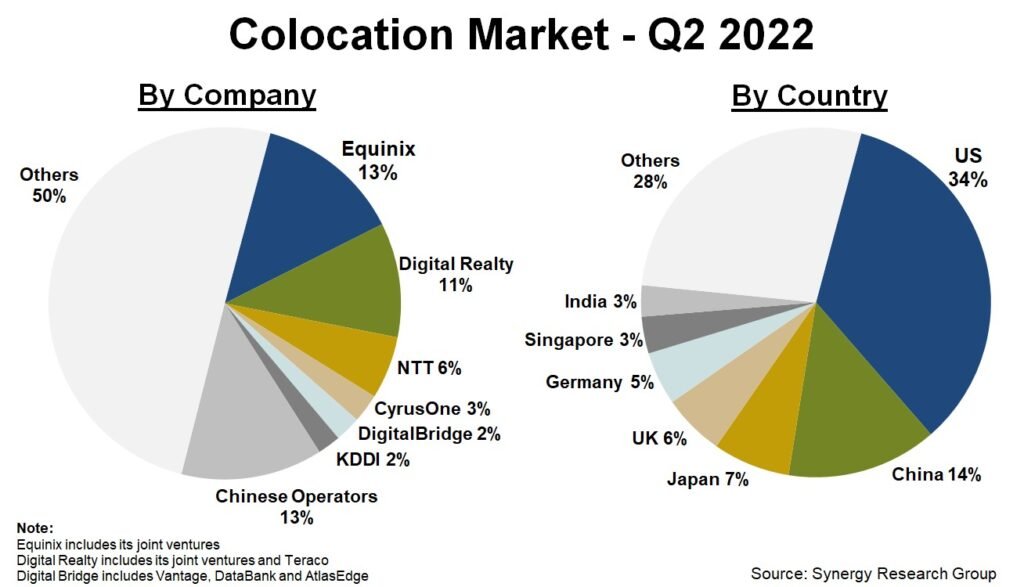

New Q2 data from Synergy Research Group shows that the six leading colocation providers account for 37% of the worldwide market. Chinese operators account for another 13% thanks to virtually controlling their home market, leaving 50% of the market which is home to an extremely long list of medium-small data center operators.

The market is led by Equinix, Digital Realty and NTT who, along with their various joint ventures, now account for 30% of all colocation revenues. They are followed by CyrusOne, the DigitalBridge group of companies and KDDI. The largest of the Chinese operators are China Telecom, GDS and VNET. Among the next tier of colocation providers, those with the highest growth rates include STACK Infrastructure, Mapletree, Chindata, Iron Mountain, Switch and H5 Data Centers.

By country the US and China account for almost half of the world market. They are followed by Japan, UK, Germany, Singapore and India, which together represent another 24% of the total. The large country markets with the highest growth rates are China, Brazil, India and Singapore.

Over the last four quarters total worldwide colocation revenues have totaled $47 billion. Excluding the impact of recent exchange rate movements, the underlying market continues to expand at a double-digit growth rate. By segment, retail colocation continues to account for the largest portion of the market, though wholesale revenues are growing much more rapidly, thanks in large part to hyperscale operators leasing large amounts of capacity.

“The colocation market continues to grow at a healthy pace, driven by large cloud and internet companies needing ever more data center capacity, and by enterprises pushing increasing amounts of IT infrastructure off premise and into multi-tenant data centers. Given the long-term nature of leasing arrangements, we confidently forecast strong continued growth over the coming years,” said John Dinsdale, a Chief Analyst at Synergy Research Group.

“The competitive landscape is a mixture of a small number of companies who are building a global footprint and a large number of national or regional specialists. Equinix, Digital Realty and NTT continue to expand globally by a combination of organic growth and by some aggressive M&A activity, but theirs is not the only path forward. Smaller data center companies can also build growing and sustainable operations by focusing on specific countries or geographic regions.”